The International Finance Corporation (IFC) created Gender Equality in Ecommerce in Africa research as part of the Digital2Equal initiative. Digital2Equal is an IFC-led initiative that brings together 17 prominent digital businesses operating throughout the online marketplace to enhance possibilities for women in emerging markets. It was launched in 2018 in collaboration with the European Commission.

Acknowledgments

The Umbrella Facility for Gender Equality (UFGE), a multi-donor trust fund run by the World Bank Group to promote gender equality and women’s empowerment, provided further financial support for this study. UFGE assists governments and the commercial sector in focusing policy and programs on scalable solutions that produce long-term results through experimentation and knowledge production. Australia, Canada, Denmark, Finland, Germany, Iceland, Latvia, the Netherlands, Norway, Spain, Sweden, Switzerland, the United Kingdom, and the Bill and Melinda Gates Foundation all contribute generously to the UFGE.

The IFC Gender and Economic Inclusion Group led this project, which was overseen by Mary PorterPeschka and Henriette Kolb. Alexa Roscoe and Charlotte Ntim were in charge of the project. Alicia Hammond, Nathalie Hoffman, Georges Houngbonon, Shalaka Joshi, Anne Kabugi, Erin Kelley, Heather Kipnis, Amy Luinstra, Angela Lumanau, Xubei Luo, Komal Mohindra, Ciku Mugambi, Qursum Qasim, Thomas Rehermann, Meriem Ait Ali Slimane, Natalia Bhatia, Yasmin Klaudia bin Humam, Rachel Coleman, Rani Rani Deshpande. Ann Casanova copyedited the report, and Titanium Room created the layout design.

Evangelia Tsiftsi, Bhattiprolou Murti, and Maria Teresa Gonzalez Garcia spearheaded the report’s communications strategy, with help from the IFC global communication team and the Africa communication team.

The study was carried out in collaboration with Kantar Public, a worldwide consulting business. Alexandra Cronberg, Susan Gigli, Nupur Kedia, Chenbi Liu, Shiyun Mai, Mark Matuma, Jordan Robinson, Samuel Schueth, and Andrew Wiseman were among the Kantar Public contributors. Oluwatosin Agbaje, Winnie Amollo, Oloo Habil, Mame Soukeye Mbaye, Frederick Ubanmhen, and Julia Wanderi offered in-country help.

Jumia submitted company data to IFC, which was used to inform this report. Stanislas Barth, Pauline Bouteiller, Benjamin De Fouchier, and Triin Visnapuu headed the Jumia project coordination, with assistance from Karine Assemien, Sefik Bagdadioglu, MarieFrance Girgis, Tolutope GeorgeYanwah, Omolola Oladunjoye, and Christine Sogomo.

Nick Imudia from Konga, Fadima Kane from SPartners, Iffat Mahmud from OyaNow, Babatunde Obrimah from Fintech Association of Nigeria, and Duncan Oyaro from FSD Kenya are among the numerous specialists who kindly contributed their time and knowledge to the team.

Forwards to Gender Equality in Ecommerce in Africa

In Africa, e-commerce is booming. Since 2014, the number of online buyers across the continent has grown at an annual rate of 18 percent on average, with similar growth expected over the next decade. According to this study, if we invest in women entrepreneurs on e-commerce platforms, this increase may be considerably larger.

The report Women and Ecommerce in Africa was created in collaboration with the European Commission, using data from one of Africa’s leading platforms, Jumia, and financing from the Umbrella Fund for Gender Equality. It is the first study in the region to demonstrate the extent to which women participate in ecommerce and how online platforms might benefit women entrepreneurs.

One of the report’s primary findings is that closing the sales gap between female and male vendors could add over US$14.5 billion to the value of the African ecommerce sector between 2025 and 2030, a benefit that would compound over the next few decades. In other words, every year that gender disparities go neglected, a market value of just under US$3 billion is wasted.

How are we going to get there? E-commerce is already a place where women entrepreneurs can make a difference. Women own just over a third of enterprises in Côte d’Ivoire and more than half of firms in Kenya and Nigeria on the Jumia platform. This is significant in and of itself, demonstrating that ecommerce is assisting women’s entry into and success in the digital economy, as well as enabling women-owned firms to compete in traditionally male-dominated industries like electronics.

Women entrepreneurs, on the other hand, continue to be held back by substantial inequalities between men and women in terms of digital and financial inclusion. The COVID19 epidemic has also been devastating. Women-owned firms saw a 34% decline in sales in the first year of the pandemic, compared to a 28% drop for men-owned businesses.

Ecommerce companies are well-positioned to buck the trend and help women entrepreneurs succeed in a field that will increasingly define business in the area and around the world. They can do so by focusing the training on women-owned firms, increasing women’s engagement in high-value categories like electronics, and encouraging greater adoption of innovative fintech solutions, which women utilize at a much lower rate than men.

There is little doubt that a company’s capacity to compete online will become increasingly important in determining whether it succeeds or fails, a tendency that has only been accelerated by the global COVID19 pandemic. Assuring that women are well-positioned to compete online will benefit both businesses and development. I hope that this data-driven study encourages ecommerce platforms and tech companies to invest in women and develop an inclusive digital economy.

Jumia was founded on the belief that technology has the power to alter Africa’s everyday existence. We created an integrated marketplace, logistics, and payment platform to enable consumers to easily and affordably access millions of items and services, while also providing a new channel for thousands of sellers to reach customers and expand their businesses.

Eight years of operations and the COVID19 pandemic have enhanced our belief in the importance of our work. The COVID19 issue demonstrated that ecommerce is more than a convenience; it is an important utility in the new world we now live in, where health and safety are at the forefront of everyday life decisions, including how we buy items.

In this new reality, it is critical to ensure that women are not left behind and have the resources, access, and tools they require to succeed. This is not only a matter of economic necessity for women but also of ensuring a stable and sustainable future for the billion Africans.

Women sellers have embraced ecommerce in all of the countries where we operate, and they are a formidable force to be reckoned with. Women vendors, for example, represent almost half of our seller base in Nigeria and Kenya. In light of this, we have continued to encourage women and advocate for gender equality. We’ve helped female entrepreneurs reach a wider market through our collaborations, training, and capacity-building programs.

We started working with IFC three years ago under the DigitalEqual project. As a result, we’ve taken additional steps to encourage female participation, including:

- Making commitments to promote gender equality on our platforms;

- attending learning events with IFC and partners, such as the International Labour Organization and the United Nations, to put gender goals into practice; and

- collaborating to publish new research on how to close gender gaps.

Much has been accomplished to date, but there is still much more to be done. The evidence given in this study clearly demonstrates that bridging the gender gap in entrepreneurship has enormous benefits for the African economy. We were able to find opportunities for women to close this gap on our platform as a result of our participation in the research. For example, tangible arrowheads are now in place to encourage women to enroll in training, compete in high-value categories, and embrace fintech.

These research findings will be very appealing to e-commerce platforms and other actors in the digital economy. There is also a strong message for African policymakers to acknowledge ecommerce platforms as important collaborators in the pursuit of inclusive growth and gender equality.

Executive Summary to Gender Equality in Ecommerce in Africa

The fast digital revolution that is currently taking place in Africa has the potential to have an equally transformative effect on female entrepreneurs. Despite the fact that there are more women entrepreneurs in Africa than men, women-owned (WO) firms tend to be smaller, have lower average sales, and employ fewer people (World Bank 2019).

The exponential growth of ecommerce in Africa offers a chance to overcome gender inequities by expanding the market for women-owned businesses. The number of online shoppers in the region increased by an average of 18% per year between 2014 and 2020, compared to a global average of 12%. (Davarpanah 2020). Similar developments might boost the sector’s worth from $20 billion in 2020 to $84 billion in 2020, a milestone that may have already been expedited by the COVID19 pandemic’s high demand for online purchasing (Statista 2020).

However, advancements in disruptive technology do not always transfer into advancements in gender equality, and there has been little research regarding women’s participation or success on ecommerce platforms to date. With the first large-scale, sex-disaggregated examination of ecommerce sellers in Africa, this paper aims to fill that information vacuum and shed light on the following crucial questions:

- What role do women entrepreneurs play in e-commerce, and how do they fare?

- What are the advantages and disadvantages of selling on e-commerce platforms for women entrepreneurs?

- Do e-commerce platforms have a business case for investing in female entrepreneurs?

To answer these questions, the research team spoke with sellers and global and regional ecommerce experts in depth; conducted surveys of representative samples of men and women sellers in Côte d’Ivoire, Kenya, and Nigeria; and analyzed data from Jumia, one of the region’s largest ecommerce platforms.

Findings and Recommendations:

This analysis revealed that eliminating gender disparities in the ecommerce sector could contribute over $1 billion to the total value of the sector in Africa, giving ecommerce companies a compelling commercial rationale.

To achieve this growth, more women must first begin selling online, and then their sales must perform as well as men’s. The following points highlight crucial facts about how women are now engaged in digital commerce and how to position women at the core of the ecommerce sector in the future.

Q1/ How are women entrepreneurs participating and performing in ecommerce?

1.1/ Businesses owned by women and men have varied reasons for resorting to e-commerce.

While both men and women are equally likely to say Jumia helped them build their business, males are more likely to join an ecommerce platform to start a new business, while women are more likely to join to expand an existing one. Women were also more likely to cite “flexibility” and “supplementing existing income” as important benefits of selling online, implying that many women are adopting ecommerce to overcome barriers to labor force participation and wages equality.

1.2/ Women entrepreneurs are engaged in ecommerce, but they need assistance to expand.

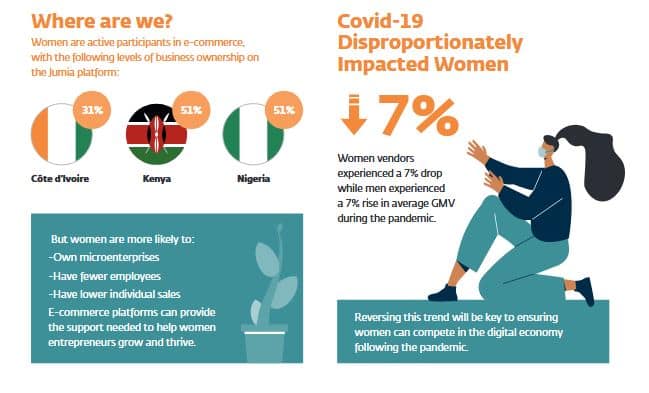

Women-owned 35% of businesses on the Jumia platform in Côte d’Ivoire, 51% of businesses in Kenya, and 51% of businesses in Nigeria. When comparing the presence of formal business ownership on the Jumia platform to national statistics in Kenya and Nigeria, WO firms were found to be more prevalent on the Jumia platform.

There are certain parallels that may be seen between the larger economy and ecommerce. For example, WO businesses are more likely to be microenterprises on the platform, but most large businesses, including Jumia’s key clients, are controlled by men. WO companies likewise had lower sales and fewer employees than MO companies.

1.3/ COVID19 has essentially reversed the WO companies’ successes.

When comparing the second and third quarters of 34 to the same period in, as COVID19 spread, WO firms saw a percentage point reduction in revenues, whilst MO businesses saw a percentage point increase. To ensure that women can participate in the digital economy after the epidemic, this trend must be reversed.

Q2/ What are the opportunities and challenges for women entrepreneurs selling on ecommerce platforms?

2.1/ Women are using ecommerce to break into more profitable industries where they have traditionally been underrepresented.

The fashion sector is currently dominated by women entrepreneurs; nonetheless, it is characterized by strong rivalry, minimal differentiation possibilities, and low profits, making it a difficult category to succeed in. Women, on the other hand, are known to use ecommerce to reach higher-value categories.

On Jumia, the electronics sector made for the majority of total sales. While males normally sold more in the electronics sector, women outsold men in this area. During the pandemic, this pattern continued, however, women’s average sales in the category fell more than men’s.

According to the World Bank, sector flipping is one of the most effective ways for women to address earnings gaps, implying that high-earning ecommerce categories can help women entrepreneurs perform better in the long run.

2.2/ Women mention increased market access and flexibility as important advantages of e-commerce.

Many men and women believed that selling on Jumia aided them in growing their enterprises. As a result, market access is a major advantage of ecommerce for women, who are more likely to have a smaller consumer base. Women were more likely than males to value the intangible benefits of selling online, such as increased freedom and more time with friends and family, in addition to the specific business support services given by Jumia.

2.3/ WOMEN AND E-COMMERCE IN AFRICA 4 new fintech services are well-positioned to solve funding gaps that platforms are well-positioned to address.

WO firms were less likely to have gotten a loan from a financial institution and were more likely to have begun with personal funds. Only 7 percent of WO businesses secured a loan through the Jumia platform after they launched, compared to percent of MO enterprises. Women requested smaller loans on average, and their applications were more likely to be accepted. This shows that ecommerce platforms can use targeted financing to expand their seller base while also closing gender inequalities.

2.4/ Women are less inclined than men to invest in sponsored product advertising.

Men were more likely than women to use paid services such as advertising by a percentage point. More assistance with product marketing and evaluating the performance of sales methods could inspire more women to take advantage of such opportunities and improve sales. Platforms can also enable women to take advantage of goods promotional services by providing timed discounted prices or trial periods, which can help women compete online.

2.5/ Women entrepreneurs place a higher value on training and business support than males.

On questions about the ease of using platform features, as well as success along the seller journey from registration to product delivery or refunds, men and women had similar results.

When asked which Jumia services they found most useful in the last few months, 48 percent of women compared to 40 percent of men said training. Similarly, compared to 17 percent of MO businesses, 24 percent of WO businesses said Jumia helped them manage profit and loss. By providing additional training through their platforms, ecommerce platforms could assist women entrepreneurs in increasing their profitability.

Q3/ What is the business case for supporting women entrepreneurs in ecommerce?

3.1/ By 2030, closing gender inequalities in sales performance on ecommerce platforms could generate approximately billion in platform revenues.

If current trends continue, the African ecommerce business is anticipated to be worth $84.5 billion by 2030. While women’s average sales currently trail behind men’s – owing in part to the epidemic –

- This study forecasts that if women’s gross merchandise value (GMV) equaled men’s by 2025, almost $15 billion in additional market value would accrue by 2030.

As a result, for every year that gender gaps are neglected during this time span, the sector loses nearly $3 billion in potential value. Because of women’s ecommerce success previous to the pandemic, reversing COVID19-related sales reductions and returning the GMV of WO and MO enterprises to parity is an obviously attainable aim.

3.2/ Attracting more women customers is key to ecommerce growth.

While the focus of this study was on ecommerce retailers, new evidence suggests that attracting female clients is also important for growth. Customers shopped more on ecommerce platforms as a result of the pandemic, according to new sex-disaggregated data, and women were more likely than men to have discovered a new online store where they will continue to buy after the pandemic (Kantar 2020).

3.3/ Platforms are well-positioned to support women entrepreneurs.

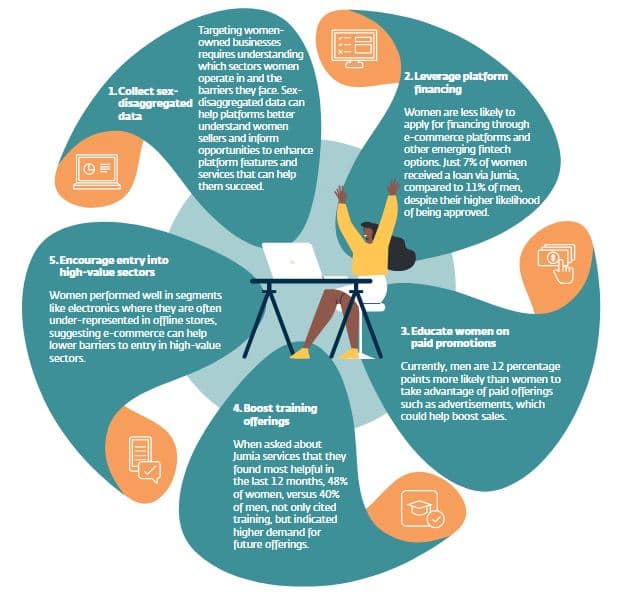

Women entrepreneurs confront significant impediments to success across the area, from digital access to business skills. This report identifies specific ways for ecommerce corporations to assist WO businesses. Among the actions taken are:

- Collect and identify sex-disaggregated data on sellers so that ongoing analysis and tailored help may be provided to WO enterprises.

- Ensure that women entrepreneurs are aware of upcoming fintech options, such as platform-administered loans, and that they may access them;

- Build on the success of the initial training by adding more information and broadening outreach to WO businesses; and

- To boost their competitiveness and success rates on the platform, encourage women sellers to use paid platform features such as product advertising and to enter high-value segments.

Conclusion

From the analysis so far, African IT News can deduce that gender equality in Ecommerce in Africa’s ecommerce sector could be worth $84 billion by 2020, up from $20 billion in 2020. Eliminating gender disparities in the sector could contribute over $1 billion to its value. To achieve this growth, more women must first begin selling online, and then their sales must perform as well as men’s. WO firms have lower sales and fewer employees than men-owned companies (MO) COVID19 has essentially reversed the WO companies’ successes.

Women are using ecommerce to break into more profitable industries where they have traditionally been underrepresented. Women were more likely than men to value the intangible benefits of selling online, such as increased freedom and time with friends and family. Jumia’s platform can use targeted financing to expand its seller base while also closing gender inequalities. The African ecommerce business is anticipated to be worth $84.5 billion by 2030. By 2030, closing gender inequalities in sales performance on ecommerce platforms could generate approximately billion in platform revenues. Women entrepreneurs place a higher value on training and business support than males.

Women entrepreneurs confront significant impediments to success across the area, from digital access to business skills. This report identifies specific ways for ecommerce corporations to assist WO businesses. Collect and identify sex-disaggregated data on sellers so that ongoing analysis and tailored help may be provided.